Pace of State Growth Slows in Q3, UMass journal reports

Supply chain & continuing pandemic impacts create headwinds for Commonwealth's economic recovery

October 2021

» Download the detailed report

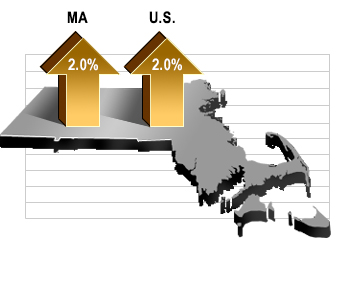

In the third quarter of 2021, Massachusetts real gross domestic product (GDP) increased at a 2.0 percent annualized rate, according to MassBenchmarks, while U.S. GDP increased at a 2.0 percent rate according to the U.S. Bureau of Economic Analysis (BEA). According to the BEA, Massachusetts real gross domestic product grew at annualized rates of 6.1 percent in the first quarter and 8.0 percent in the second quarter, while U.S. real gross domestic product grew at annualized rates of 6.3 percent and in the first quarter and 6.7 percent in the second quarter.

In the third quarter of 2021, Massachusetts real gross domestic product (GDP) increased at a 2.0 percent annualized rate, according to MassBenchmarks, while U.S. GDP increased at a 2.0 percent rate according to the U.S. Bureau of Economic Analysis (BEA). According to the BEA, Massachusetts real gross domestic product grew at annualized rates of 6.1 percent in the first quarter and 8.0 percent in the second quarter, while U.S. real gross domestic product grew at annualized rates of 6.3 percent and in the first quarter and 6.7 percent in the second quarter.

The slowdown in the pace of growth from the second to third quarter is the result of the Delta variant of COVID-19 restraining the pace of reopening, associated ongoing supply chain disruptions and labor shortages, and less exuberant consumer spending on goods, especially durable goods. Much of the growth that did occur was driven by increased consumer spending and associated job growth in the leisure and hospitality, as well as other services sectors. Inflation diminished the impact of this consumer spending on real output and by extension real GDP growth.

Payroll employment in the third quarter expanded at a faster pace than in the second quarter. The number of jobs in Massachusetts grew at a 6.9 percent annual rate in the third quarter as compared to a 6.3 percent rate for the U.S. In the second quarter, the rate of jobs growth was 4.3 percent in Massachusetts versus 4.8 percent in the U.S. Year over year, since the third quarter of 2020, employment has grown by 6.2 percent in Massachusetts versus 4.6 percent in the U.S. Despite this growth, total employment in Massachusetts remains 5.8 percent below the pre-pandemic peak in February 2020, a larger jobs deficit than the nation, which in Q3 stood at 3.3 percent below its previous peak.

The unemployment rate in Massachusetts rose during the third quarter, from 4.9 percent in June to 5.2 percent in September. At the same time, it fell in the U.S., from 5.9 percent in June to 4.8 percent in September. "While the rise in the unemployment rate in Massachusetts may reflect persons returning to the work force, participation rates are still well below pre-pandemic levels and the number of unemployed in the state, at 193,000 in September is still well above its pre-pandemic levels of 105,000 in February of 2020," noted Alan Clayton-Matthews, MassBenchmarks' Senior Contributing Editor and Professor Emeritus of Economics and Public Policy at Northeastern University, who compiles and analyzes the Current and Leading Indexes.

"One encouraging sign is that the number of persons who are working part time but who want full-time work has returned to pre-pandemic levels. However, labor market conditions are still far from normal. In February 2020, the state's unemployment rate was 2.8 percent or just over half of the September 2021 rate," Clayton-Matthews added.

Massachusetts wage and salary income in the third quarter, estimated from state withholding taxes net of unemployment insurance withholding, grew at a 13.8 percent annual rate. This compares favorably with MassBenchmarks' estimate of U.S. wage and salary growth of 9.5 percent in the third quarter. According to the BEA, wage and salary growth in the second quarter was 8.3 percent for Massachusetts and also 8.3 percent for the U.S. The core rate of consumer price inflation — the CPI excluding food and energy — was 5.3 percent in the third quarter and 8.1 percent in the second quarter. While average real wage and salary income per payroll worker may have advanced slightly in Massachusetts in the third quarter it did not in the U.S., and it declined in the second quarter both in Massachusetts and nationally.

Spending on goods subject to the regular state sales taxes and motor vehicle sales taxes declined in Massachusetts in the third quarter at a 5.8 percent annual rate, after rising by a 40.3 percent annual rate in the second quarter. This decline mirrors the decline in spending at the national level. In Massachusetts, the decline was concentrated in motor vehicle sales, which fell at a 36.7 percent annual rate. This can be largely attributed to supply shortages and a low vehicle inventory.

In the fourth quarter of this year and first quarter of next year, MassBenchmarks expects the state economy to expand at a 4.5 percent annual rate, consistent with continued gradual progress in getting back to normal and assuming there is no seasonal COVID-19 surge as temperatures drop. This reflects a dampening of the optimism that was present earlier this summer. The AIM Business Confidence Index fell in both August and September, and the Conference Board's Consumer Confidence Index for the U.S. declined throughout the third quarter. However, both indexes are at levels that indicate a continuation of moderate growth.